My Thoughts: 2024 Nest Realty RDU Housing Report

Interest rates are reducing the number of sales, but not pricing

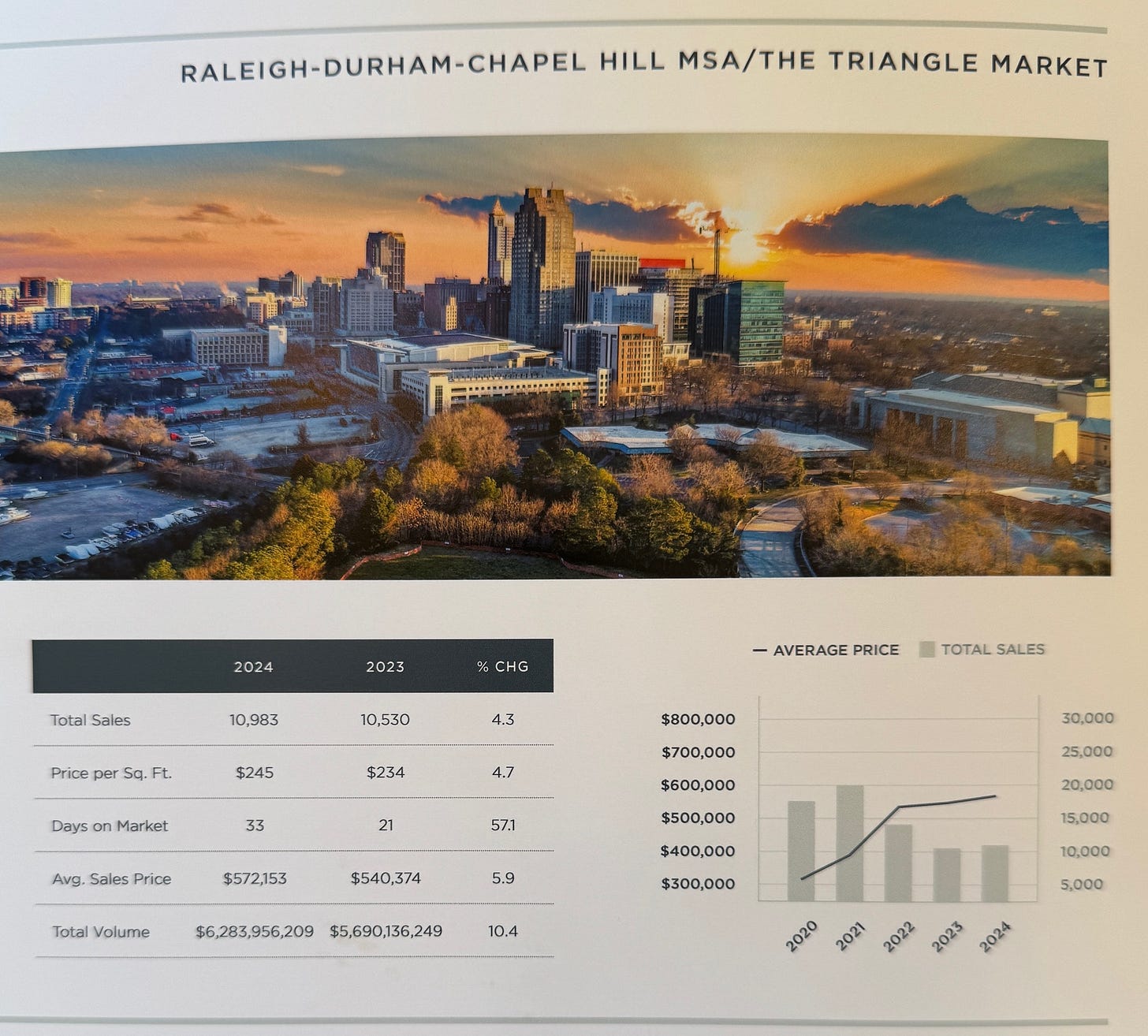

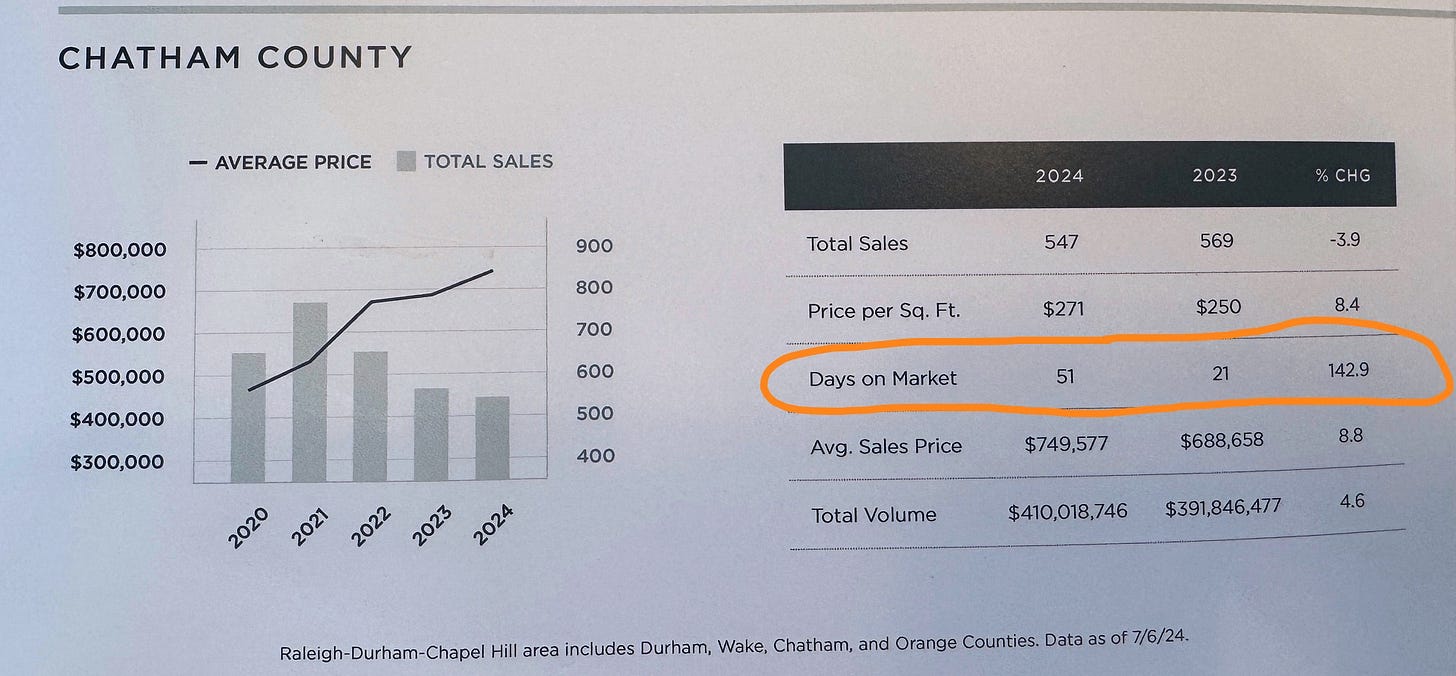

Twice a year, Adam Dickinson of Nest Realty publishes a market report. The pamphlet, which he mails to clients, breaks down data by county—Wake, Durham, Orange, and Chatham—showing five years for Average Price and Total Number of Sales, and two years of data for Price Per SF, Days on Market (DOM), and Total Volume.

I have always found the results comprehensive and engaging. I like the report because it’s simple but straightforward—it’s everything you need and nothing you don’t—a great way to synthesize what’s happening in the region. Below, I parse out the three most interesting stories in 2024:

The Top Three Things:

Durham continues to have the most affordable Average Sales Price in the region, at $465,485, and that phenomenon is holding up. Prices have also gone up the least since the pandemic's beginning, and have slowed the fastest since rates went up in 2022.

The most significant data change (by percentage) is the number of Days On Market (DOM) in Chatham County, which jumped from 21 days to 51 in 2024, a 142% change, indicating a severe softening of that micro market.

In 2024, there were half as many listings in the Triangle as there were in 2021 (10000 vs 20000), indicating a major and perhaps unprecedented drop in transactions.

ANALYSIS

The headline story is still interest rates. New construction was hard math when rates were at 3%, and now construction loans are 8%, and 30-year debt is at 7%. If the build-for-rent model isn’t dead, it is asleep, with little sign of it starting back up any time soon. One of three things will have to give to unleash that model again:

Rates have to go down,

Construction costs (including labor and material) have to go down, or

Rents have to go up.

I see minor signs of downward pressure on rates, but not enough to get people to enter the market. Construction costs are staying persistently high. Sales remain high but are losing steam in home price appreciation across the Triangle. Rents appear to be going down, actually, not up (though this was not part of the Nest Report), a sign that supply is working and that build-for-rent starts will be depressed for the foreseeable future.

The huge shift in Chatham DOM is remarkable. This could be a few things. First, it could be that people really prefer urban living. Chatham is detached from jobs and entertainment, traffic is terrible and getting worse, and as Chatham Park gets built out, the county will slowly shift from exurb to suburb.

Second, Chatham Park is such a massive project that it could easily (at times) overbuild, and that extra inventory could show up in DOM and skew the results. Related, Chatham is the least populated of all the counties, so it could just be a smaller (noisier) data set and not really that relevant.

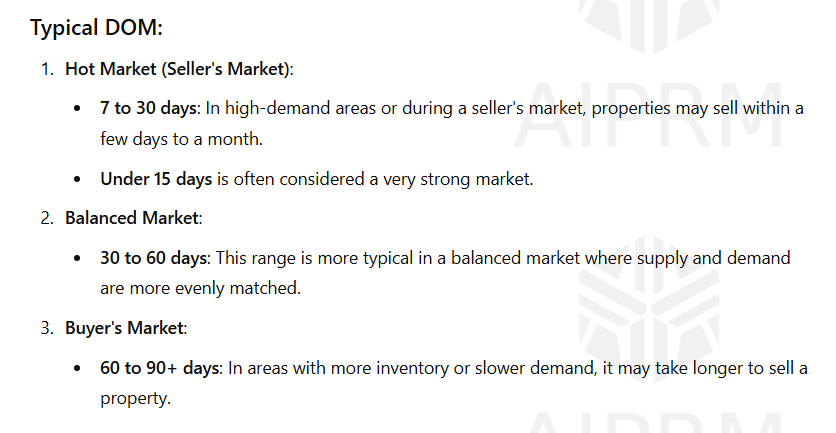

Still, 30-60 Days On Market is considered a" “Balanced Market”, something the Triangle has not seen in more than a decade. In fact, while Chatham is pushing toward being a “Buyer’s Market” (60 DOM+), three of the Triangle’s four counties would now qualify as a “Balanced Market”, with only Orange County being “Hot (Seller’s Market)”, barely, averaging 28 DOM. This general softening might signify things to come, as rates stay persistently high.

As DOM grow, there is less incentive to build. It is a market signal that things are cooling—or are at least cooler—from the red-hot sizzler we experienced a few years ago.

WHAT DO I SEE?

Separate from Nest’s 10,000’ high altitude data, I see two market bifurcations of note:

Rental Markets and Sales Markets have detached. There is little appetite to build new rental housing right now, as costs exceed market rents. And this is present in both incremental and institutional markets. Sales, however, remain strong, and both local homebuilders and nationals seem not to be slowing down at all. That’s probably good news for homebuyers but less for renters who hope for better choices and lower pricing. Vast portions of the market are rate stuck, unable to sell their home because it would force them to trade a 3% note for one at 7.5%. So they sit, and transactions of existing homes plummet. It’s great for new home construction, which, unfortunately, is now a significant accelerator of sprawl.

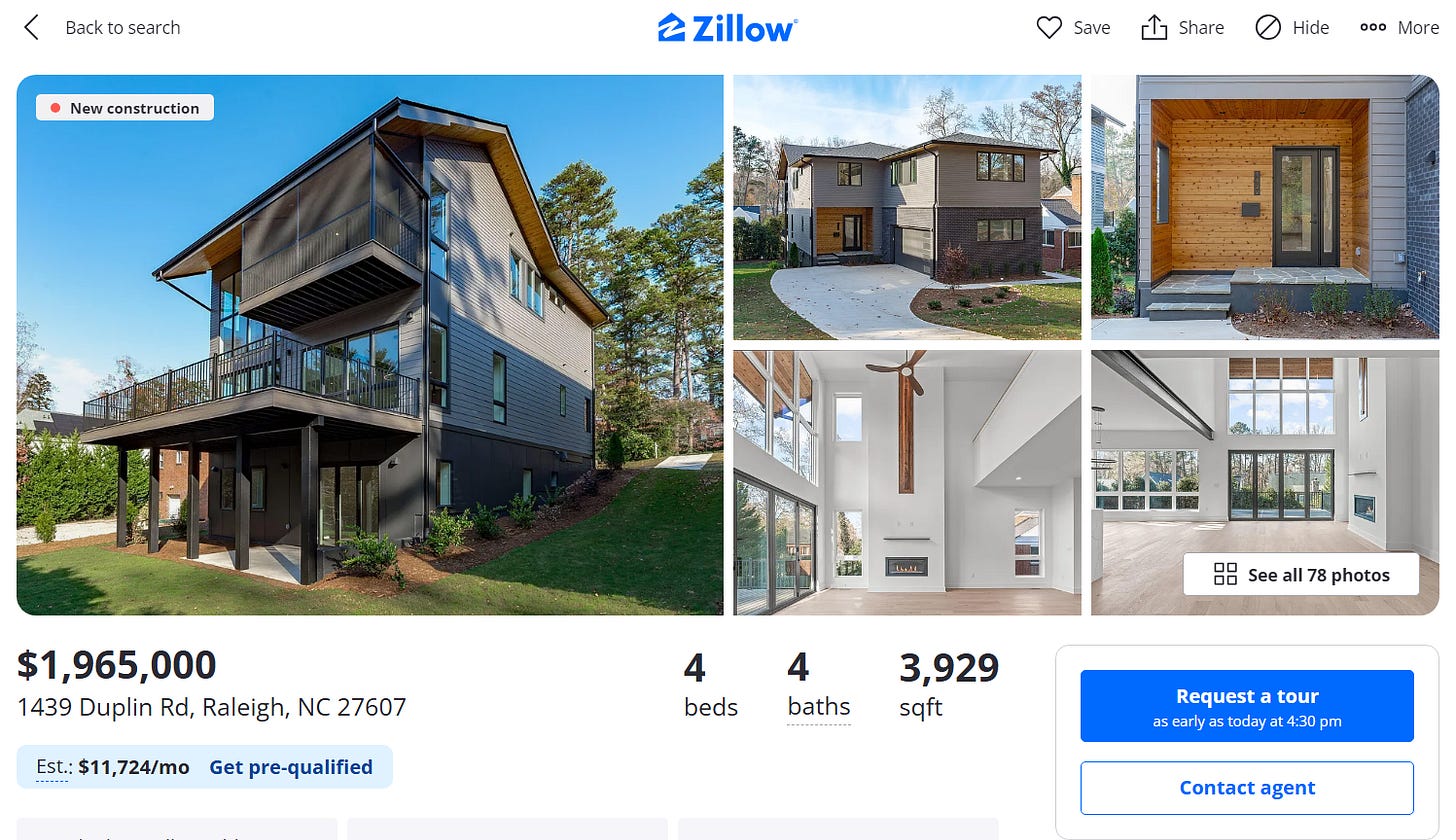

The middle of the market is hollowing out. For a time, rate hikes killed the middle to the middle-upper end of the market. I remember talking to a realtor of a $2m spec home in Raleigh. He said, “Under $500k? It sells overnight. Over $1m? If you price it right, it sells quickly. But $500k-1m? I can’t even get people to look at it!” Why? That’s because sub-$500k in the Triangle is a starter home with limitless demand, and over $1m is frequently a cash buyer, insulated from rate hikes. But the $500k-$1m market is successful people, often with two jobs, a kid, a dog, two cars, but no trust fund. Those folks, which I suspect are a plurality in NC, got sucker punched by interest rate spikes. A $800,000 home with 2020 rates was a $1600 monthly interest payment. Today it is $4000.

Even so, there remains an acute shortage of mid to high-end urban housing in Durham. In my experience, this is disproportionately the Duke-migratory buyer market: professors, staff, and grad student families. Because these buyers are relatively up-market, their supply shortage is traditionally dismissed as “not a policy problem”. “Those folks don’t need our help” is the attitude.

But it is a problem. If buyers in the $500-$800k cannot find a house in urban Durham, but are determined to live there, then they start looking at rehabbing old homes or tearing down and building new (though the knockdown culture is still a fraction of that in Raleigh). The inability to find new homes in this price range puts pressure on poorer neighborhoods. This is how a lack of supply leads to displacement.

We need new housing in this mid-market range. It’s always been short but is even shorter now that so many of the infill lots have shifted to fill the starter home market through the Small Lot Code (2019 reforms) that allowed three smaller homes to be built on lots where Raleigh & Chapel Hill would typically build one $1-2m home. I wrote about that phenomenon, which was published at StrongTowns.

Durham has done a great job of restarting the starter home market, perhaps better than any city in America, but it’s done so at the expense of building less for relatively wealthy people. It is a good problem to have, but it is still a problem.

PREDICTING THE FUTURE

Looking forward to 2025, I have no crystal ball. I always found it ridiculous when people approach real estate professionals like soothsayers. Former Durham Planning Director Pat Young was constantly asked to predict precisely how many units various reforms would yield. He had no idea.

Planners are not fortune tellers. And I am not either. It is silly for people to demand certainty in an uncertain world.

What is certain is that the Triangle is still booming. You can see a long, long list of #LongNC tweets here, mostly curated by bullish crêpier Jason Cox. People are moving here because it's great, there are jobs, and despite recent appreciations, it remains relatively affordable. That does not appear to be changing any time soon.

All in all, the Nest Report is a bunch of data that indicates the bull run will continue.

It’s funny that everyone seems to understand the scarcity version of filtering, aka gentrification - a person who has enough money for a “mid market” home but can’t find one to buy will buy an entry level home and remodel or rebuild it into a mid market home. And yet many people deny the reverse phenomenon, that having more upper and mid market housing allows people to move up which creates more supply of entry level homes. Sigh.